The Financing Process

Demystifying Home Loans

The home loan process can feel overwhelming. By collaborating with a trusted lender and remaining informed through every step of the process, from pre-approval to closing, you can have a significantly more comfortable experience. You

Our Preferred Lender

First Coast Mortgage Funding

Jason Kindler & Amanda Solari

NMLS ID #1953441

11363 San Jose Blvd Building 200, Jacksonville FL 32223

firstcoastmortgagefunding.comJason Kindler

(904) 253-9912With a career spanning over two decades in the mortgage industry, I have been at the forefront of making homeownership dreams a reality for clients across the United States since 2001. My journey in this field has encompassed a wide range of roles, all driven by a deep-seated passion for assisting individuals and families in achieving their homeownership goals, all while ensuring they receive unparalleled service.

As a seasoned mortgage broker, I take immense pride in the reputation of First Coast Mortgage, a company I started in 2020. Our commitment to excellence is unwavering, and we consistently deliver the most competitive rates paired with an optimal cost structure, thanks to our extensive network of lenders. It is my personal mission to stay at the cutting edge of industry trends and insights, enabling me to provide expert guidance not only to our clients but also to our dedicated staff.

Located in the heart of Northeast Florida, I am dedicated to serving this vibrant community with the highest level of expertise and professionalism. Whether you are a first-time homebuyer or a seasoned investor, trust First Coast Mortgage to make your homeownership journey a smooth and successful one.

I live in Jacksonville and have a beautiful daughter Julia and amazing son Jay.

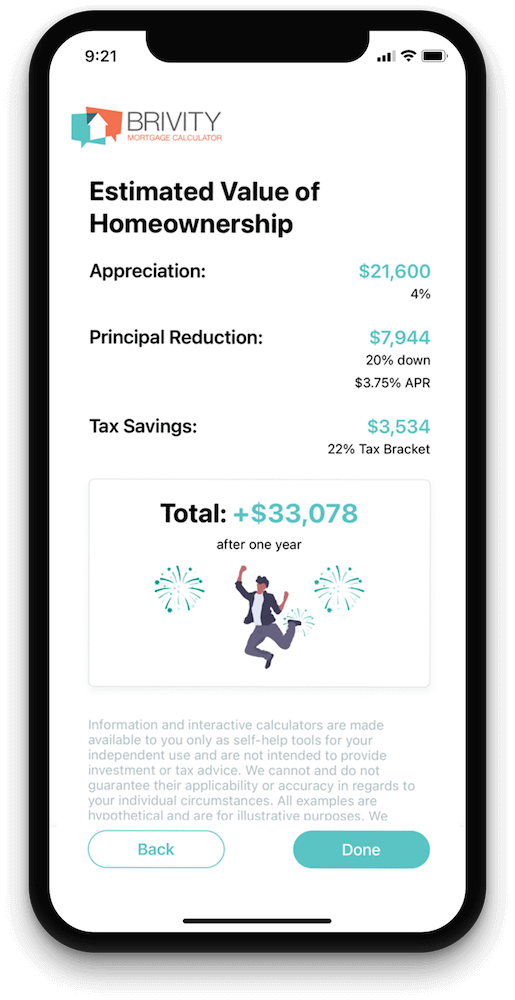

Step One:

Get Pre-Approval

Before you start looking for a home to buy, it

Estimate Your Monthly Payment

Estimate your mortgage payment, including the principal and interest, taxes, insurance, HOA, and Private Mortgage Insurance.

Price

Annual Tax

Loan Term (Years)

Down Payment %

Interest Rate %

Monthly HOA

Monthly Insurance

$3,198.20

Estimated Monthly Payment

Principal

$2,398.20

(75.0%)Taxes

$500.00

(15.6%)Private Mortgage Insurance (PMI)

$0.00

(0.0%)HOA

$100.00

(3.1%)Insurance

$200.00

(6.3%)

Step Two:

Find the best loan

Collaborating with a top-notch local loan officer will ensure you have access to competitive rates and programs that best fit your individual needs. Take the first step by completing this form to get connected today!

Step Three:

Application and processing

When you find the perfect property and your offer is accepted, your lender will help you complete a full mortgage loan application, discuss down payment options, and explain any related fees.

Then, your application is submitted for processing where the documents are reviewed. Your lender will also order a home appraisal and a property title search.

The next part of the application process involves sending everything to an underwriter who will review and approve the entire loan package to make sure it meets all compliance regulations.

It is not unusual to receive requests for additional documentation or clarification during this phase of the application process.

Step Four:

Signing and finalizing the deal

Once your loan is approved, you